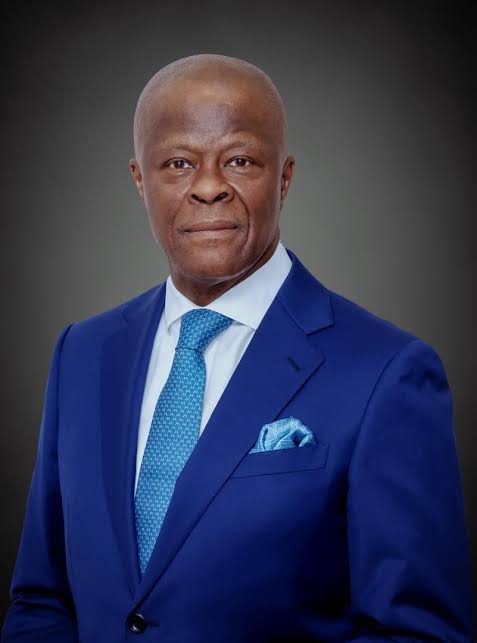

Nigeria’s public debt has climbed to ₦152 trillion, but the surge is not the result of fresh borrowing, Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has clarified.

Speaking at the launch of the Nigerian Economic Summit Group (NESG) 2026 Macroeconomic Outlook Report in Lagos, Edun said the headline figure largely reflects transparency reforms and exchange rate adjustments rather than fiscal recklessness.

According to him, about ₦30 trillion of the debt represents previously unrecorded Ways and Means advances that have now been formally captured, while nearly ₦49 trillion resulted from the revaluation of Nigeria’s foreign-denominated obligations following naira devaluation under ongoing economic reforms.

Edun stressed that Nigeria’s debt profile remains sustainable, noting that the country’s debt-to-GDP ratio has improved to 36.1 per cent—one of the lowest in Africa and well below global averages.

“Our debt figures reflect transparency and exchange rate correction, not reckless borrowing,” he said, urging the media and the public to focus on debt sustainability ratios rather than absolute figures.

The minister said the clarification underscores Nigeria’s transition from economic stabilisation to consolidation under President Bola Tinubu’s Renewed Hope Agenda.

He highlighted key gains recorded in 2025, including a drop in inflation from 33.18 per cent in 2024 to 14.45 per cent by November 2025, GDP growth of 3.78 per cent by the third quarter, external reserves of $45.5 billion, naira stability below ₦1,500 to the dollar and a ₦19.33 trillion trade surplus in the first nine months of the year.

Edun also noted improved fiscal discipline, with the budget deficit contained at 3.4 per cent of GDP, stronger non-oil revenue performance and 84 per cent implementation of the 2024 capital budget despite oil revenue shortfalls. He added that states benefited from increased federal allocations.

Looking ahead to 2026, the minister projected GDP growth of 4.68 per cent, inflation averaging 16.5 per cent and naira stability around ₦1,400 per dollar.

He said the proposed ₦58.18 trillion 2026 budget, tagged “Budget of Consolidation, Renewed Resilience, and Shared Prosperity,” will devote ₦26 trillion—44 per cent of total spending—to capital projects, financed through a carefully managed 4 per cent deficit.

Edun disclosed that structural reforms, including full digitalisation of revenue collection, improved treasury transparency, elimination of leakages and a pro-poor tax regime, would strengthen debt management and drive inclusive growth.

“Nigeria cannot afford to pause or retreat. The task now is to turn stability into sustained, inclusive and job-rich growth,” he said, adding that the reforms are expected to translate into lower food prices, better infrastructure, more jobs and stronger social protection.