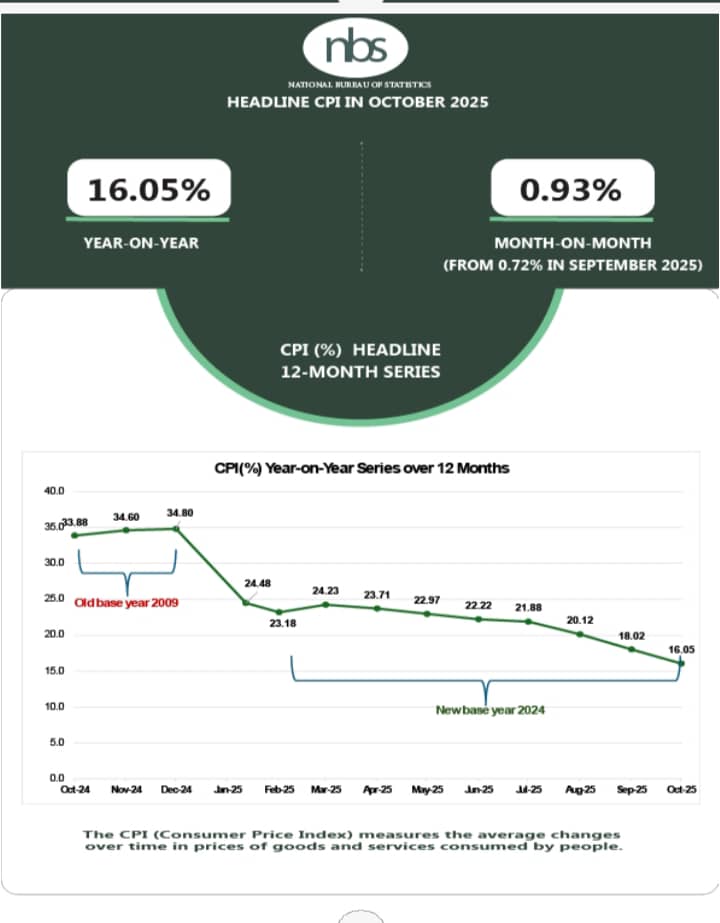

ABUJA — Nigeria’s headline inflation rate continued its downward trajectory in October 2025, dipping to 16.05% from 18.02% the previous month, according to fresh data from the National Bureau of Statistics (NBS). 0 The figures, released Monday, mark the seventh consecutive monthly decline and offer a glimmer of relief for households battered by years of soaring prices, though analysts caution that underlying pressures in food costs remain a stubborn drag on the economy.

The Consumer Price Index (CPI), which measures the average change in prices for a basket of goods and services, climbed to 128.9 points in October, a modest 1.2-point increase from September’s 127.7. 2 On a year-on-year basis, inflation stood at 17.82%, a sharp improvement from the 33.88% recorded in October 2024 — a drop attributed partly to a rebased calculation period starting from November 2009. 9 Month-on-month, the rate ticked up slightly to 0.93% from September’s 0.72%, hinting at lingering short-term volatility. 1

Food prices, long the Achilles’ heel of Nigeria’s inflation battle, were the dominant force behind the October uptick. The food and non-alcoholic beverages category contributed 6.42% to the overall rate, with staples like onions, fruits, shrimp, and meat seeing notable increases. 1 Food inflation itself eased to 13.12% year-on-year, down 26.04 percentage points from 39.16% a year earlier, buoyed by seasonal harvests and a stronger naira. 2 Other key contributors included restaurants and accommodation services at 2.07%, and transport at 1.35%. In contrast, sectors like health, clothing and footwear, and insurance saw more subdued impacts, each under 1%.

The three-month average CPI ending October rose 22.09% year-on-year, while the 12-month average climbed 22.02% — both reflecting a 10.24 percentage-point slowdown from October 2024’s 32.26%. 2 This broader cooling trend underscores the effects of recent policy measures, including the Central Bank of Nigeria’s (CBN) interest rate cut to 27% in September — the first in five years — amid stabilizing global oil prices and improved agricultural output.

Urban and Rural Divides Persist

Inflation’s retreat was evident across urban and rural landscapes, though disparities highlight ongoing inequities. Urban year-on-year inflation fell to 15.65%, a 20.73-point plunge from 36.38% in October 2024, with the 12-month average at 22.68% — down 11.84 points. 3 Month-on-month urban pressures edged higher to 1.14% from 0.74%.

In rural areas, the rate stood at 15.86% year-on-year, 15.73 points lower than the prior year’s 31.59%, with the 12-month average at 20.81% — a 9.42-point improvement. 3 Rural month-on-month inflation dipped to 0.45% from September’s 0.67%, suggesting some seasonal relief in agricultural communities.

These patterns point to a fragile stabilization, with economists eyeing the CBN’s upcoming Monetary Policy Committee meeting on November 24-25 for potential further rate adjustments. 6 “While the headline drop is encouraging, the base effect and persistent food vulnerabilities mean true relief for low-income families is still uneven,” said one analyst, speaking on condition of anonymity. “Sustained investment in supply chains and subsidies will be key to locking in these gains.”

The NBS data arrives as Nigeria grapples with broader economic headwinds, including subsidy removals and currency reforms under President Bola Tinubu’s administration. Yet, with inflation now at its lowest since March 2022, there is cautious optimism that the worst may be over — provided structural reforms keep pace. 6