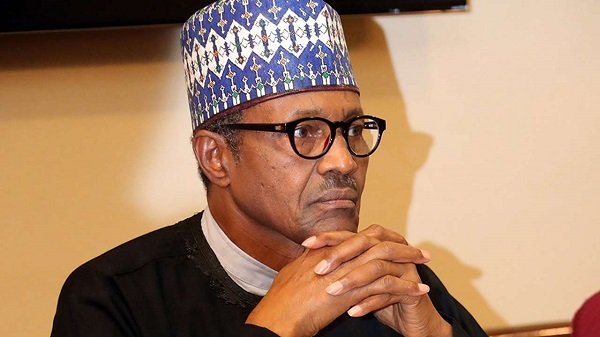

President Muhammadu Buhari will introduce the Central Bank Digital Currency (CBDC), dubbed eNaira, on Monday, marking the official commencement of the digital version of the Nigerian naira’s operation (NGN).

The e-Naira, which was supposed to be launched on October 1 but was postponed owing to Nigeria’s Independence Day, according to the Central Bank of Nigeria (CBN).

Mr Osita Nwanisobi, Director of Corporate Communications at the Central Bank of Nigeria, said in a statement on Sunday that the launch of the eNaira was the result of extensive research by the apex bank to make transactions easier for Nigerians.

The bank further highlighted that the eNaira is a version of the physical currency rather than an investment platform, citing thorough consultations with banking partners, merchants, and financial technology (fintech) operators and users.

Speaking further about the electronic currency in the statement, Nwanisobi said: “Since the eNaira is a new product, and amongst the first CBDCs in the world, we have put a structure to promptly address any issue that might arise from the pilot implementation of the eNaira.

“Accordingly, following Monday’s formal launch by the president, the bank will further engage various stakeholders as we enter a new age consistent with global financial advancement,” he noted.

The apex bank has themed the eNaira as: ‘Same Naira, more possibilities’ and it can be used by creating an eNaira wallet.

The CBN has also urged Deposit Money Banks (DMBs) to facilitate prompt placement of restrictions on eNaira wallets in the event of a valid report of loss, theft of device or compromise and a hack of a user eNaira wallet.

CBN had launched the eNaira Regulatory Guidelines earlier this month which empowers customers to report compromises of the eNaira wallet via USSD channels, internet banking platforms, customer care phone lines, and in-branch customer care.

The apex bank had said about 10 percent of the naira note in circulation will be converted to the e-Naira and had set the limit of transactions in the framework.

For instance, in the Tier 0 category or phone number without verified National Identity Number (NIN), the daily transaction is limited to N20,000 with a balance or e-wallet limit set at N120,000.

For the Tier 1 category with verified NIN, the daily transaction reaches N50,000 with N300,000 e-Naira wallet balance. Those in Tier 2 category can do N200,000 daily and have N500,000 e-wallet balance while for Tier 3, they can do N1 million daily transaction and hold N5m via e-wallet.

CBN further said merchants or individuals that have full clearance have no limit as to the e-Naira transaction they can do.